Update: CMHC raising premiums for multifamily housing because of IFRS 17

Who's thinking about the big picture?

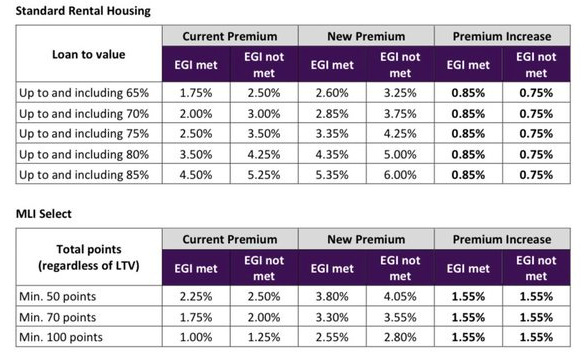

A while ago I sent an email to CMHC asking why CMHC was raising its mortgage loan insurance premiums for constructing multifamily housing.

I did receive a response within a couple weeks, although without a lot of detail:

The increase reflects the adoption by CMHC of new accounting standards through the International Financial Reporting Standards 17 (IFRS 17) and related changes that came into effect January 1, 2023. IFRS 17 impacts how revenue is recognized and increases the amount of capital CMHC is required to hold.

In addition, changes to tax rules now require tax expenses to be payable immediately rather than over the life of the insurance contract.

For a detailed discussion of how IFRS 17 affects capital requirements for a different sector, life insurance, see this July 2022 post by Michelle John at the regulator OSFI.

Of course financial stability is critically important, and it’s quite possible that there were no other options available to CMHC’s insurance business - that previously the insurance premiums were underpricing risk. I still wonder who’s thinking about the big picture: we have a severe shortfall of housing in BC and Ontario, the sharp increase in interest rates has slowed housing starts, and this change is pushing in the wrong direction.

This is a technical change that’s not salient to the general public, which means it’s not going to be on cabinet’s radar. You’d expect someone in the permanent civil service (i.e. someone high up in CMHC) to be thinking about it.