The idea with the carbon tax is that the more you tax something, the less of it you get. So raising taxes on new housing means that we’ll get less of it. When we have a terrible shortage of housing in Vancouver, this is bad.

Metro Vancouver calls for developers to pay even more (Western Investor, April 25)

The motion, approved April 19, gives staff a mandate to overhaul its 2024 budget and move toward a plan that would lower Metro fees for single households by more than 16 per cent between 2022 and 2026. The plan, however, would also increase development cost charges levied to developers when they build new residential or commercial projects.

On April 28, the Metro board will decide whether developers, including those building new homes, will cover almost 100 per cent of the ballooning cost of water and sewage, the most expensive infrastructure, as part of Metro's 2024-2028 Financial Plan.

Currently there is an 82.5 per cent development fee on sewage infrastructure costs and Metro's new water infrastructure fee will be 50 per cent of related costs.

The change means ”that 99 per cent of the cost of system expansion is covered by development cost charges rather than water sales to water district members or liquid waste services levies to sewerage and drainage district members,” explained Jennifer Saltman, a communication specialist with Metro Vancouver.

The Metro Vancouver DCC rates would be on top of any municipal charges for new real estate developments.

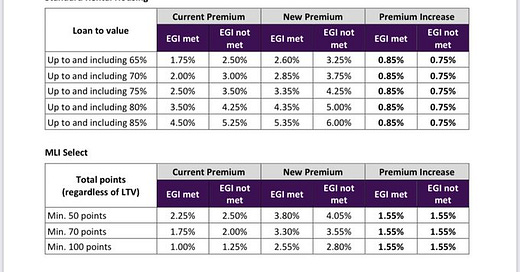

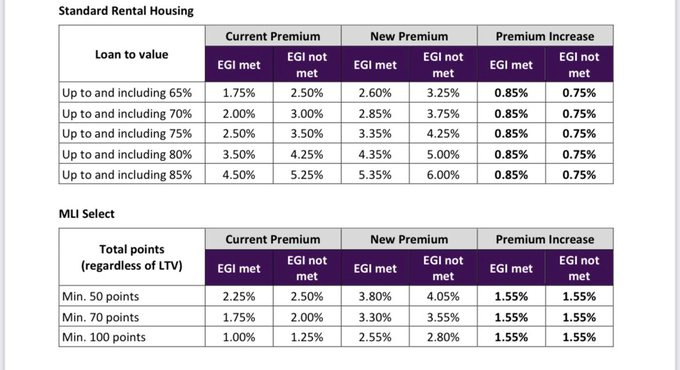

CMHC announced that it would be increasing mortgage loan insurance premiums for MLI Select and other rental projects. I haven’t seen any real explanation.

I sent an email query; so far I haven’t heard anything. The email:

The recent announcement of increases to mortgage loan insurance premiums for MLI Select and other rental properties seems to have caused confusion and bafflement. Rising costs make fewer rental projects economically viable, and this change will put further pressure on the brake pedal.

https://www.linkedin.com/feed/update/urn:li:activity:7054134402078969856/

https://twitter.com/ronmortgageguy/status/1649386866192314371

Is there a backgrounder available that describes the reasoning for this decision? Or if not, any kind of explanation?

The press release says that it's the outcome of an annual pricing review, but I haven't seen any publicly available information about what this review typically takes into account. (There was a brief press release in April 2022 saying that there had been a review, and there was no change to premiums.) The 2023 press release says that the increase is related to IFRS 17, but doesn't say how.

There's speculation that IFRS 17 increases reserve requirements. But OSFI appears to be saying that their objective is to avoid significant capital impacts.

https://www.seeingbeyondrisk.ca/2022/07/capital-frameworks-in-canada-are-ready-for-ifrs-17/

In the absence of information about the actual reasoning, I think it's likely that people will impute all sorts of nefarious motives to CMHC.