NYC: A huge housing boom in the 1920s

Al Smith temporarily exempted new housing from property tax

On Twitter, Paul E. Williams quotes a description of what happened in the 1920s in New York City:

New York City’s property tax incentive in the 1920s was a temporary exemption from property taxes for new residential construction:

The Al Smith Law

In 1920, New York Governor Al Smith signed a law that exempted new housing construction from property taxes until the end of 1931. The law did not exempt land values.Housing boom

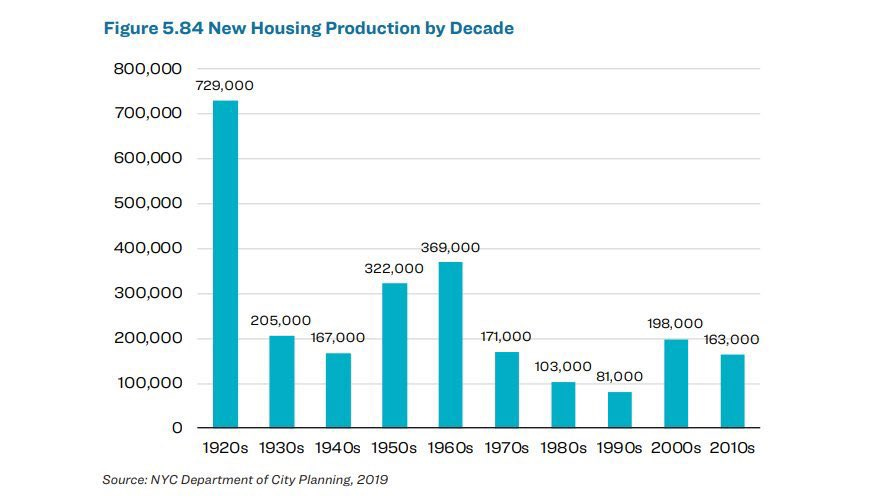

The tax exemption led to a housing boom in New York City, with over 760,000 new units built. This was more than double the amount of housing built in any other decade.

For more, see The Resurgence of New York City After 1920: Al Smith’s 1920 Tax Reform Law and Its Aftermath (2001), by Mason Gaffney. Gaffney was a Georgist economics professor. He argued for taxing land more heavily than buildings, first assessing the value of the land as if it were empty, then treating the value of the building as a residual (total property value minus land value).

Taxing land more heavily provides a strong incentive to build on underused land. For example, suppose you shift property taxes entirely to land. If you have two properties side by side that are the same size, one with an apartment building and one with a parking lot, they both pay the same property tax. But the parking lot generates much less income, making it harder for the owner to pay the property tax. So the owner has a good reason to turn it into something more valuable, instead of leaving it mostly empty.

More

The Housing Twenties: New York’s Biggest Building Boom and Its Lessons for Today. Jason Barr, Building the Skyline, October 2024.

Previously: The downside of low property taxes. Includes a section on land value tax.