Video: How Vancouver and Toronto taxed their way into the housing crisis

Uytae Lee explains hidden development charges

A video by Uytae Lee (About Here) on development charges in BC and Ontario, from May 2024. They’re hidden, which means that there isn’t much pressure to keep them low, compared to more visible taxes like property taxes: in many BC and Ontario municipalities, they’ve been skyrocketing. There’s also “scope creep”: they’re not just used for infrastructure, they’re used for more and more unrelated municipal amenities (like a $144M sports facility with a FIFA-size indoor soccer field in Kitchener).

They’re basically a way to stick renters and homebuyers with as much of the bill as possible, keeping property taxes low for homeowners and investors.

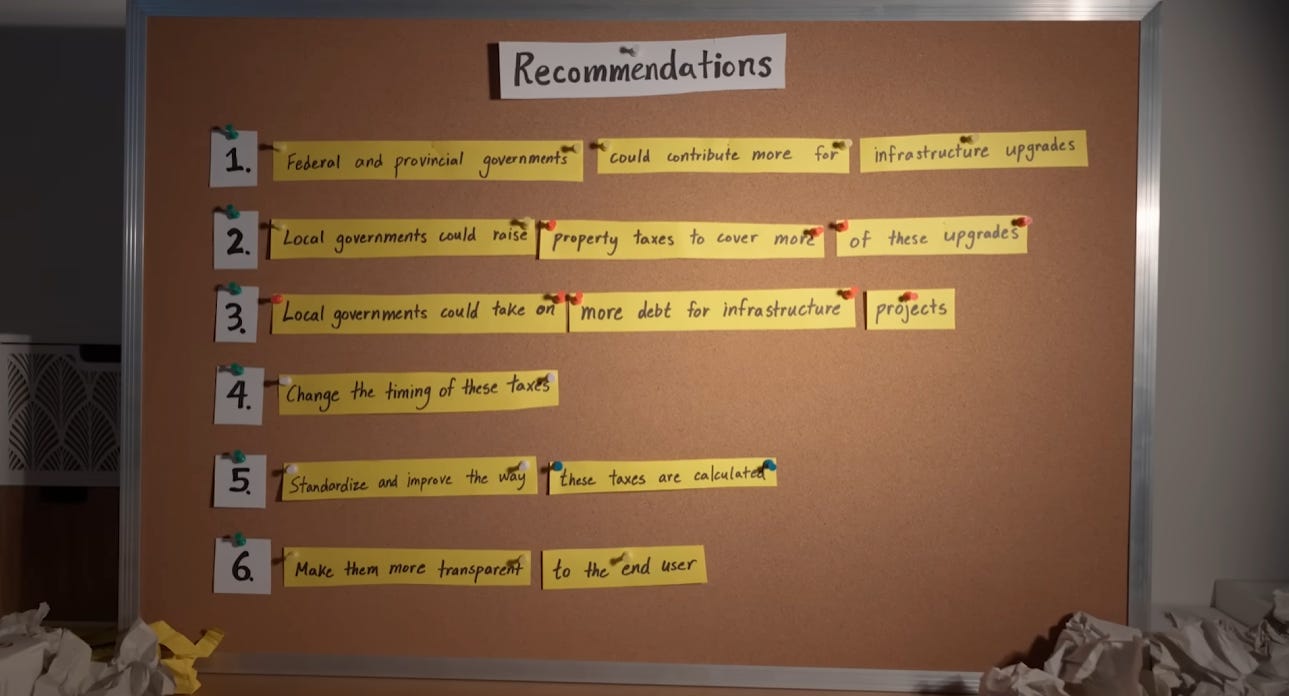

A useful list of suggestions, explained in more detail in the video:

(1) Federal and provincial governments could contribute more for infrastructure upgrades

(2) Local governments could raise property taxes to cover more of these upgrades

(3) Local governments could take on more debt for infrastructure projects

(4) Change the timing of these taxes

(5) Standardize and improve the way these taxes are calculated

(6) Make them more transparent to the end user

For more details on recommendation (6), see How a Direct-to-Buyer Development Charge System Can Save Homebuyers $68,000, Mike Moffatt, Missing Middle Initiative, July 2025. There’s also a followup article, Legislation, Loans, and Lock-Ins: The Mechanics of Direct-to-Buyer DCs, August 2025.

Cities with the highest development charges for low-rise projects:

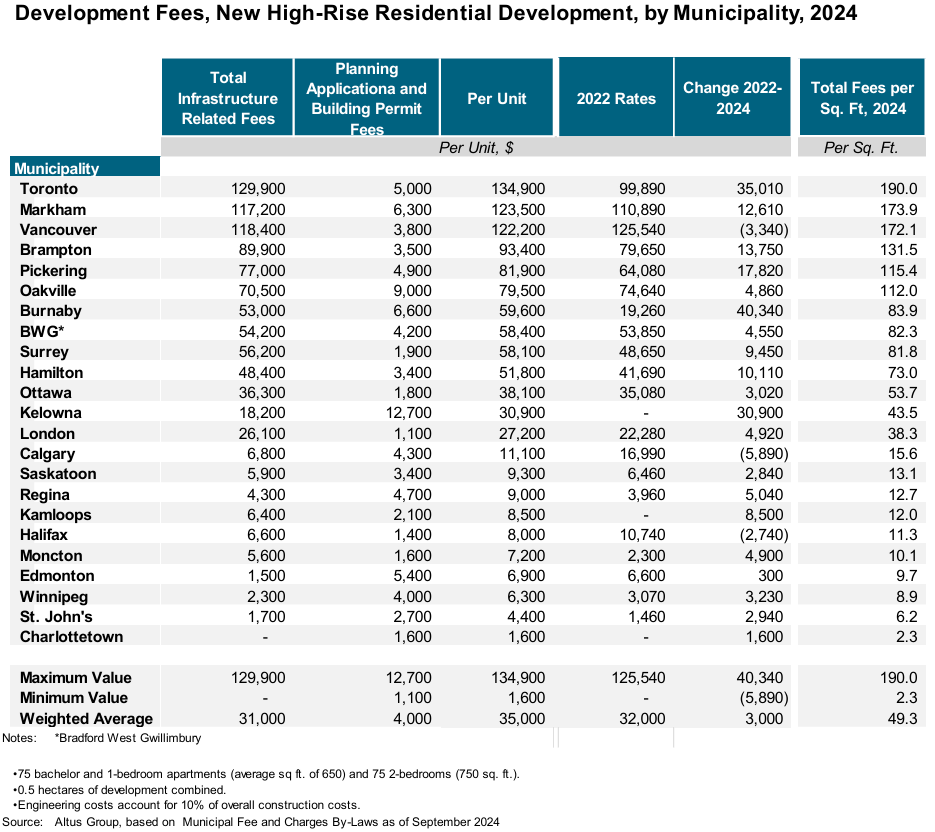

For high-rise projects:

More

Government Charges on Residential Development in Canada. Eric Bond, Francis Cortellino, Taylor Pardy, and Christopher Zakher. CMHC Housing Market Insight, July 2022. “At the upper end, municipal government charges can represent more than 20% of the cost of building a home. (1) These fees add a direct cost to the production of housing. (2) Fees may add complexity and uncertainty to the development process as construction timelines hinge upon the successful collection of fees.”

Mario Polese on Montreal vs. Toronto. “The city of Montreal (and the region) largely remained true to a philosophy of urban planning wherein the infrastructure costs of new housing developments are shared by all residents, not just newcomers, via local property taxes and provincial taxes. The result: Montreal levies no impact fees on developers. So-called auxiliary fees are sometimes charged, generally for immediately proximate amenities (such as parks), but according to recent estimates, the total sum of local charges imposed on developers for comparable new housing units is between one-fifth and one-sixth of those in Toronto.”

Deny Sullivan on Moncton’s continuing housing boom, with homebuilding rates comparable to Calgary and Edmonton. “How is this surge made possible? I can see a couple factors. First, fast timelines. A 2024 study from the Altus Group shows that while a builder could waste 2 years applying for permits in Toronto, in Moncton that’s about 2 months. Then, with permits in hand, Toronto wants $134,000 per unit in fees and taxes for the pleasure of building homes. In Moncton? It’s only $1,600. Near zero municipal fees on housing make many more projects viable - and those projects are happening.”

In BC, many municipal politicians and staff don’t believe that development charges raise the floor on prices and rents, slowing down or halting homebuilding. Comments on July 10 presentation to Metro Vancouver finance committee. Jerry Dobrovolny, Metro Vancouver Chief Administrative Officer, in 2023, on planned development charge increases: “The DCCs will not change housing prices. And I know that may be controversial for some, but I will say that unequivocally to you all now. The DCCs will not change housing prices.”