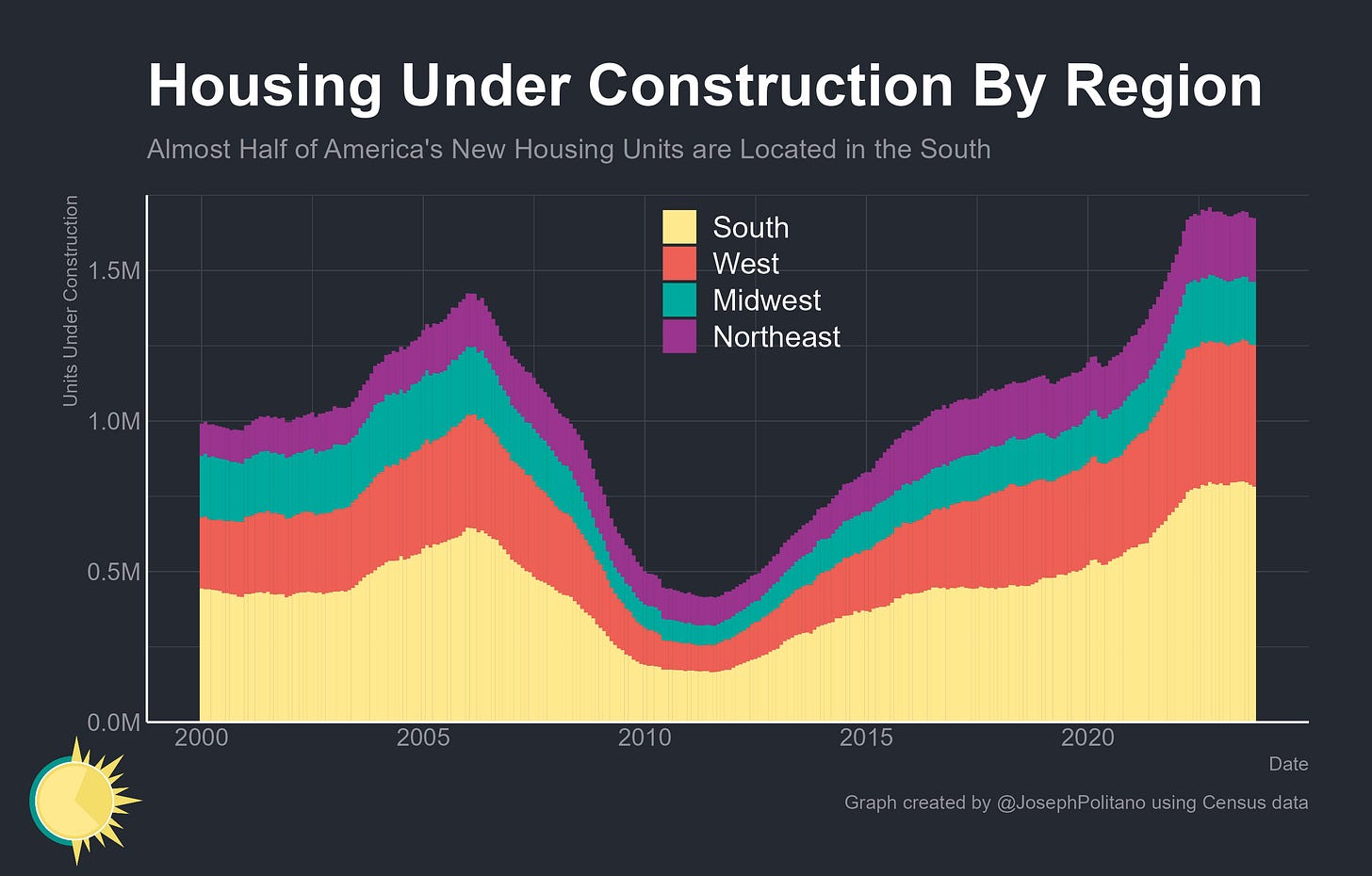

Joseph Politano notes that there’s been a homebuilding boom in the US since late 2020 and 2021, especially in the South.

There remain more than 1.6 million units under construction across the United States—near the highest levels in modern history, including a record high of nearly 1 million multi-family units. At the current pace of completions, roughly 1.5 million units are going to come online in 2023, the highest level of additional supply since 2006, and roughly 800k of those units will be in the South. In a world where new, empty housing is increasingly scarce, that will likely fuel further Southbound domestic migration.

There’s a number of US cities where additional supply is already pushing down rents. Redfin:

In November 2023, the median asking-rent for 0-2 bedroom rental properties in the South was 0.4% lower than one year ago. Specifically, the top 3 metros experiencing the most significant year-over-year rent declines are Orlando, FL (-6.0%), Austin, TX (-5.4%) and Dallas, TX (-4.1%). Between October 2022 and 2023, the South experienced a slight increase in the unemployment rate, which edged up from 3.1% to 3.2%, signaling a robust labor market and indicating strong rental demand despite the uptick. While the demand remains vigorous, the supply side presents an even more compelling picture with a substantial 32.0% growth in the annual multifamily completion rates in Jan-October 2023 than a year ago. This heightened supply has contributed to a downward push on rent prices, resulting in an overall decline in rental costs.

Landlords facing more competition

Noah Kagan (one of the first employees at Facebook) reported in November that he lost a $100,000 investment with a real estate syndicate in Austin. The syndicate provided an explanation which seems reasonably clear: interest rates are up, so they need to pay more in interest every month, and there’s a lot more supply on the way.

Several factors have led to financial challenges in the multifamily real estate market and this specific asset. The reality is that we acquired this property in December 2021 at the peak of the market, and since then, multifamily fundamentals have deteriorated rapidly. In December 2021, SOFR was 0.05%, Austin market occupancy stood at 93%, and this asset was bought at a 3.4% cap rate. Since then, SOFR has risen to 5.32%, Austin market occupancy has dropped to 88% with a 20-30% increase in supply coming available leading to the lowest Austin market occupancy of all time. Multifamily cap rates have expanded to a 6% cap rate. Even if the market stabilizes at a 5% cap, we must increase NOI by 50% to get back to breakeven. NOI ultimately cannot cover both debt service increasing from $171k per month to $340k per month, and increased operating expenses.

Recent BOVs have valued the asset at $160k/door, and the debt is $200k/door. It is not worth the debt. Given these circumstances, it is not financially viable to continue. We greatly appreciate investors’ contribution to the capital call in March 2023. However, considering the current market conditions, it would be imprudent to utilize the remaining funds. Our goal is to return as much capital as possible to investors who participated in the capital call.

The GVA Team has worked diligently to find a viable path forward, including multiple attempts with LoanCore to restructure the loan. Unfortunately, this has been unsuccessful, and LoanCore has requested receivership by January 2, 2024 leading to a foreclosure.

The pipeline is drying up

Higher interest rates have been slowing down homebuilding in Canada, and it sounds like the same thing is happening in the US.

Henry Epp, Marketplace, October 2023: America needs more houses, but homebuilders are hobbled by high interest rates. Housing completions are at record highs, but permits are down.

In a lot of parts of the country, the first thing a homebuilder has to do to build housing is get a permit. And the number of permits issued last month fell over 7% compared to a year ago because the math doesn’t really work for builders right now, said Jessica Lautz, deputy chief economist at the National Association of Realtors.

“It’s hard to find a buyer who can afford a new build, but also it’s expensive to build a home,” Lautz said.

It’s expensive for a few familiar reasons: Construction costs are high, it’s hard to find skilled workers, but most of all, “the increase in long-term interest rates,” said Robert Dietz, chief economist at the National Association of Home Builders.

Just like homebuyers taking out mortgages, homebuilders take out loans too.

“As interest rates increase, the cost of financing for acquiring land, developing building lots, and the construction loans for builders, all of those increase,” Dietz said.

Katie McKellar, Deseret News, October 2023:

While Utah was among the top states to boom amid the pandemic housing rush, now it’s one of the states to constrict the most.

Only four other states — Montana, New York, Wyoming and Alaska — saw a sharper decline than Utah in the percent change of residential units receiving building permits from 2022 to 2023, housing experts Jim Wood and Dejan Eskic, researchers at the University of Utah’s Kem C. Gardner Policy Institute, wrote in a report published last month.

Utah’s number of residential building permits plummeted by 37.2% from June 2022 to June 2023. Compare that to the national decline in building permits, which fell 17% in the same period, according to the report.