Texas: lots of supply is pushing down rents

A building boom is good for renters

Texas apartment markets could take a financial hit as oversupply exacerbates rent declines. Olivia Lueckemeyer, February 2024, Bisnow.

You sometimes hear supply skeptics argue that it’s impossible for more supply to bring down prices and rents. Patrick Condon:

If building new supply produces affordability, then Vancouver should have become the most affordable. But that did not happen. Why?

Condon seems to be getting cause and effect backwards.

Where prices and rents are high, that’s a strong incentive for developers to build more, and you get more new construction. Where prices and rents are low, you get less new construction. That’s why there’s a lot more new construction in Vancouver than in Saskatoon.

Matthew Yglesias, The Rent Is Too Damn High:

It’s as if you noticed that fires always coincide with the appearance of fire trucks and concluded that the fire department was burning buildings down. The truth, obviously, is the reverse. Fire trucks show up because buildings are on fire. Similarly, real estate developers show up when land prices are rising.

When housing is scarce and expensive, as it is in Vancouver, we should be making it easier to build new housing, not harder, as we’ve done since the 1970s.

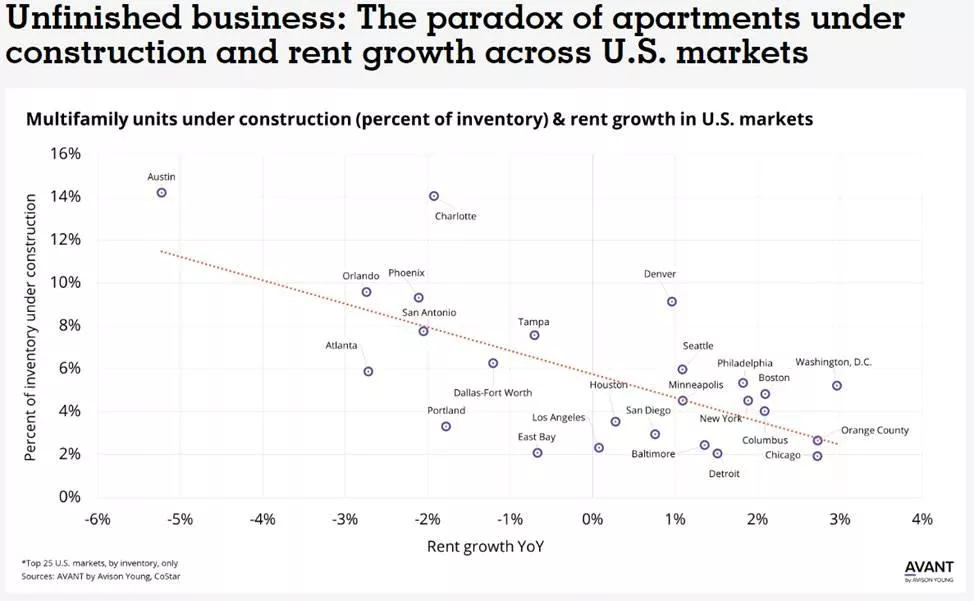

The current situation in Texas illustrates how a lot of supply results in lower prices and rents:

Unprecedented levels of in-migration and a trend of corporate relocations caused demand for apartments to spike in Texas in the early years of the pandemic, pushing rent growth into the double digits. Developers rushed to cash in on the nation’s most promising real estate investment, fueled by cheap debt and a growing pool of renters unable to afford a home.

Since then, competition has increased as new supply floods the market and the cost of capital has gone up. Owners who financed their properties using floating rate debt are facing the difficult prospect of refinancing, leaving some with few options but to sell at a discount or hand keys back to the bank.

In Austin, asking rents are down 5% year over year, and there’s 40,000 apartments under construction.

More

The US homebuilding boom. An investor put $100,000 into a real estate syndicate to buy and operate a rental building in Austin. He just lost his entire investment: interest rates are up, rents are down, there’s more supply coming, and the syndicate declared bankruptcy. Their lenders will need to sell the building at a lower price, based on the smaller stream of future rents. Bad news for him, good news for renters.

The US boom is now ending, because of the sharp rise in interest rates.

There’s a lesson here for municipal governments. When the economics line up - when interest rates are low, for example - it’s important to take advantage of the boom, so that you don’t end up missing the boat. The window of opportunity isn’t open forever: selling prices and costs are always shifting, sometimes rapidly. You need to build a huge amount when you can, to compensate for the times when you can’t. In Vancouver, it would have been much easier to build when interest rates were lower and there was plenty of capital available.

1000 Cypress Street. A striking illustration of just how restrictive Vancouver’s zoning is. An old eight-unit rental building, built in 1972, can’t be replaced with a new building of the same size.

Great post, and an illustration of supply and demand at work, which for many is hard to believe because all they have seen are rising prices!