Shrinkflation: Vancouver apartments are small because cost per square foot is high

They have to shrink so that people can still afford them

[Repost, originally posted May 2024.]

At a recent Housing Happy Hour event, someone commented that new apartments in Vancouver are getting smaller and smaller.

The underlying problem is that cost per square foot is so high. There’s no free lunch: somebody has to pay for the incredibly labour-intensive and expensive approval process, and for the hundreds of millions of dollars extracted in development charges. And extremely restrictive limits on height and density mean that these costs can’t be spread over more square feet of floor space.

When the cost per square foot goes up, apartment sizes have to shrink, or nobody would be able to afford them.

Suppose you can afford a mortgage of about $500,000. (At an interest rate of 5.6%, the monthly mortgage payment is $3100, requiring a household income of about $125,000 to be affordable. TD mortgage calculator.)

If apartments sell for $600 per square foot, then a 750-square-foot apartment would sell for about $450,000.

But if apartments are selling for $1200 per square foot, then a 500-square-foot apartment would sell for about $600,000. You’re paying 1/3 more, for 1/3 less space.

Joel Schlesinger, Edmonton Journal, November 2023: Edmonton’s multi-family market tops among major centres to rent or buy.

Zonda Urban reports that the first three months of the year saw strong price growth for wood-frame apartment condominiums and townhomes with year-over-year growth at about 23 per cent and nearly 10 per cent respectively.

Yet the average price for a new wood-frame condo in Edmonton is still about $317 per square foot compared with about $412 per square foot in Calgary, and about $1,200 per square foot in the Greater Toronto Area.

More

CMHC analysis of the large gap between hard construction cost per square foot and selling price per square foot in Vancouver and Toronto. This is a strong incentive for people to build more, but municipal regulations prevent that from happening.

Bobby Fijan explains the logic of building smaller rental apartments, so that more people can afford them:

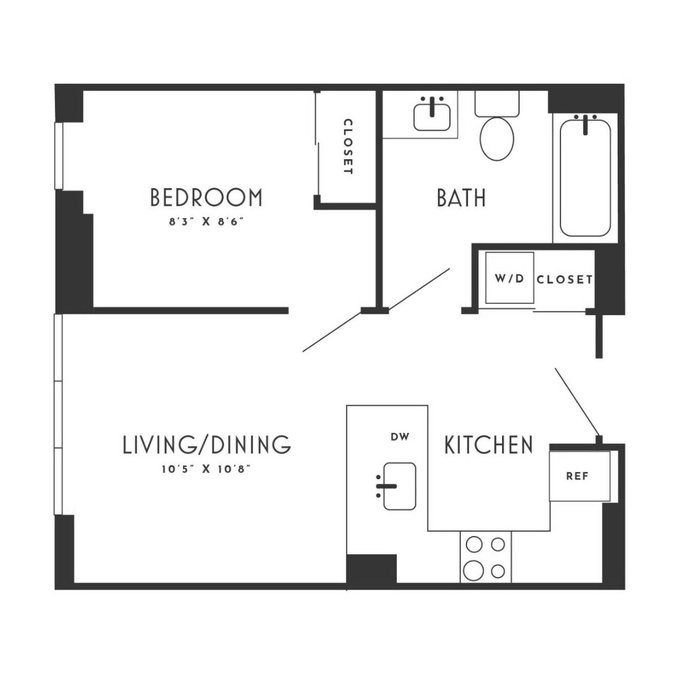

Here's the most efficient floorplan for a new construction 1BR apartment. 415 square feet. This layout is made possible by breaking 3 “rules” common to US apartments:

1. Narrow bedroom (only 8’6”)

2. Reach-in closet (rather than “walk-in”)

3. No en-suite bathroom accessWhy are "efficient" floorplans better, particularly in new construction buildings?Because smaller units mean *lower* rents.

Here's a unit in same market. Floorplan has about the same unit depth but more traditional bedroom & living room widths. 10'8" in bedroom is enough for TV opposite headboard.

But this extra width makes unit nearly 600sf. Developer needs 40% higher rent.

There's no doubt that a wider bedroom is "nicer" in a vacuum. But floor plans are always about choices. How many young people would like to live in same neighborhood in same building and same amenities ... and pay 30% less, but it means their bedroom only fits a queen size bed? Most.

That $3,100 monthly paymnt you mentioned is actually closer to what buyers really face when you include property taxes and insurance on top of principal and interest. A lot of first time buyers get surprised when they realize their actual housing costs are higher than what the mortgage calculator shows them. The full PITI calculation is critical for understnading true affordability.

When you need $125k household income just to afford a $500k mortgage, it really shows how mortgage insurance premiums add another layer of cost most people can't absorb. Shrinking units is one response, but it doesn't solve the underlaying affordability crisis for first time buyers who already face PMI or MIP on top of inflated prices.