Kevin Milligan on Rustad's tax-credit proposal

"Does nothing for growth, makes the deficit substantially worse"

On Tuesday, John Rustad announced a “Mortgage Rebate” tax credit for renters and mortgage-holders. There’s a lot of confusion about what this actually means. Reading through Kevin Milligan’s commentary on Twitter, it looks like it’s $900M in spending, distributed as a tax credit for $900/year. It’s unclear who’ll get it, because there’s only enough money for about 37% of households.

This policy doesn’t make much sense to me - it seems like an overly complex $900M tax cut, resulting in higher prices and rents. Tax cuts are always popular, but it doesn’t make us any better off, because we’re already running a deficit and the additional $900M needs to get paid back with interest. Short-term gain, long-term pain.

What’s the problem that it’s trying to solve? The economy is already overheated, with shortages of housing in particular. We’ve got an unappetizing choice between some combination of higher prices (inflation), higher interest rates (tighter monetary policy), and higher taxes / spending cuts (tighter fiscal policy). Running up the deficit by another $900M seems like it’s heading in exactly the wrong direction, creating more inflationary pressure and making it more difficult to balance the budget.

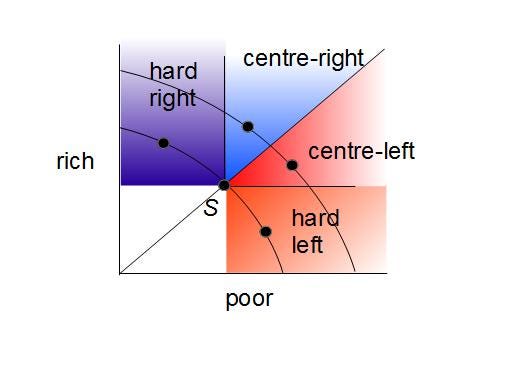

It looks like pure shiny-object redistribution (“bribing us with our own money”), rather than trying to make us better off by growing the economy or improving incentives to fix the housing shortage. (The only obvious incentive is that it’s an incentive to carry a mortgage instead of paying it off.) And it undercuts any claim that the BC Conservatives are the party of fiscal responsibility.

Ok, so many confusing reports on this tax proposal. It looks like they intend a tax credit.

Unclear whether this would be a refundable or nonrefundable tax credit. That's kind of a crucial detail.

BC has a large deficit and ever-growing spending needs. This is a tax credit that does nothing for growth and just makes the deficit substantially worse. It is fiscally reckless.

Another aspect of this tax credit---they cost it at $900M. The max amount in 2026 is $1500×5.06%x12 months is $900/year. So, that's 1M recipients/year who could get the full amount. There are about 2.7M families in BC. So, only about 37% of families could get full amount.

To be fair they say they will means test the housing credit.

If you're going to make $900/yr to 2.7M families fit in a budget of $900M/yr you need to *heavily* means test this. I wonder what clawback rate? 35%? That's always a challenge with basic income style transfers like this!

If they go with a 35% clawback rate, that would substantially increase the effective tax rate on earnings for BC middle class households.

And I'll note this large budget expenditure doesn't get one unit of housing built.

More

B.C. Conservatives promise major rebate to address housing costs. CBC News.

Conservatives promise provincial tax rebate to offset housing costs for renters and homeowners. Joanna Lee-Young, Vancouver Sun.

Joseph Heath, Lessons for the left from Olivia Chow’s faltering campaign. Describes policies that make everyone better off, as opposed to policies that are just redistribution.

Alex Usher: basic policy questions.