Investing in real estate is risky

OSFI is limiting residential mortgages to no more than five rental properties

Disadvantages of real estate as an investment

When you invest by buying shares in a business, it’s because the business generates income, keeps some of it to expand the business (e.g. opening a new store or finding new customers), and pays out the rest to shareholders as dividends. Over the long term, you can expect capital gains, because the future income of the business should increase as it expands. By investing in a low-cost index fund, and thus spreading your investment over a wide range of businesses, you can avoid the risk of any one business or sector doing badly. By investing regularly, you can avoid the risk of putting all your money in when people are particularly optimistic and stock prices are at a peak.

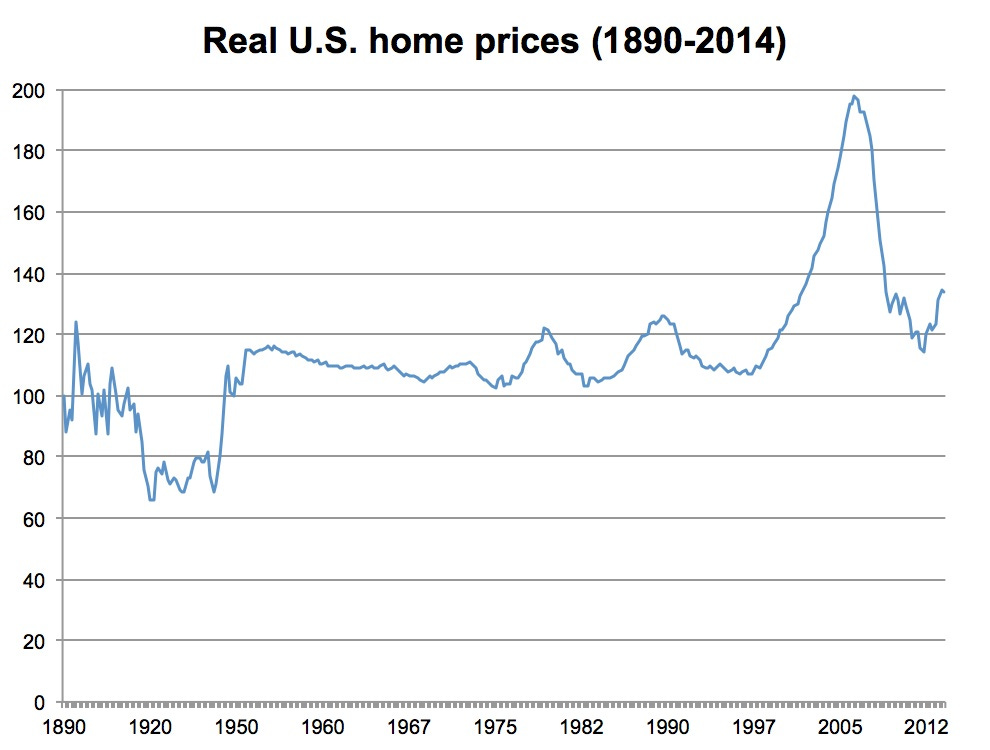

When you invest by buying rental property, you also get a stream of rental income, as well as the prospect of capital gains, because future rents may be higher than they are now. But you’re completely undiversified - what happens if a big earthquake hits Vancouver? And you run the risk of buying in at the peak, as happened to investors in Toronto in the late 1980s: after inflation, prices didn’t recover for 20 years.

Alex Avery notes that over the 25 years from 1991 to 2016, a period when house prices rose as interest rates fell, the stock market outperformed housing. The average annual return on the S&P/TSX composite index was 8%, while the average annual return on Canadian house prices was 3.7%, after taking maintenance and transaction costs into account. That's a 2.5X difference in total return over 25 years.

Given these disadvantages, why do so many people invest by buying real estate instead of index funds?

There’s two reasons:

(1) Familiarity. We all know what houses look like, and we have a good idea how their values have changed over time. We have much less familiarity with businesses and share prices.

(2) Leverage. When buying a property, you typically get a loan (mortgage) from a bank, and repay the loan over a long period of time. This amplifies your gains: if you have a down payment for 10% of the property value and a loan for 90%, then if prices rise 10%, your return is 100%. But leverage cuts both ways: if instead prices fall 10%, you’re wiped out.

A mountain of debt

For individual investors who have a lot of faith in real estate, and no concern about diversification or leverage, there’s a strategy called “BRRRR”: Buy, Rehab, Rent, Refinance, Repeat. You borrow against your existing rental properties to buy more.

Reading about the popularity of the BRRRR strategy with novice investors, I’m reminded of Charles Kindleberger’s observation: “There is nothing so disturbing to one’s well-being and judgment as to see a friend get rich.”

As long as prices are going up, using debt to keep buying more properties works great. But if the market starts falling, you suddenly find yourself stuck with a mountain of debt. Your lenders have the “senior claim” on your properties, while you have the “junior claim”: in other words, your equity gets wiped out first, while your lenders still need to be repaid.

Mortgage broker Ron Butler says that OSFI, the federal bank regulator (the Office for the Superintendent of Financial Institutions), is bringing an end to the party. Twitter thread.

Does The Bank Regulator Plan To Stop Rental Investors Getting Lots Of Residential Mortgages? YES They Do

Part of the current OSFI review of residential mortgage rules is controlling creation of rental "empires"

10, 15, 20 rental properties with residential mortgages is rare

But they do exist and OSFI wants no more of it

The most recent general limitation on residential mortgages for individuals is 1 owner occupied home, 1 vacation home and 5 rental properties

Rental properties could be up to 4-plex but only 5 individual titles as residential

People can have as many rentals as would work under Commercial mortgage rules but Residential is capped

When OSFI issues their final proposal this summer the likelihood is likely further restrictions on total individual mortgage debt

The concept is becoming quite clear

OSFI the Bank Regulator has concluded that large numbers of rental mortgages under Residential rules must end

Commercial lending doesn't work for many investors

Moving forward, provincially regulated credit unions and private mortgage lenders will be asked to fill the gap

Private mortgage lending is obviously much more expensive than bank lending, and credit unions are unlikely to support financing of large numbers of investor mortgages - it's a fundamental risk issue

Will commission mortgage professionals try to develop strategies? Find methods to circumvent these rules? Likely

But OSFI will keep tightening as time goes on

They have made their decision: Canada's banking system is NOT here to promote individuals creating rental empires

Commercial Mortgages: OK Residential Mortgages: NO

More

The real estate evangelist — why buy one home when you can buy 100? Financial Times, March 2022. Profile of David Greene (BiggerPockets), who popularized the BRRRR strategy. Includes skeptical comments by Kenneth Rosen, an economist: “Buying hundreds of properties as an individual, I think, unless you’ve got a lot of experience managing them, is just a recipe for a disaster when the downturn happens, and the downturns do happen. If you use hard money or other types of risky leverage, that is the wrong way to buy things. It works well on the upside, but it works terrible on the downside.”

A more recent article on BRRRR investors in Austin: Real-estate investors seized upon a tried-and-true strategy to fix up homes and make money. Then the market turned. AJ LaTrace, March 2023.

For a strategy better suited to novice investors, see the Canadian Couch Potato. This is the approach I use: basically half in GICs and half in low-cost index funds. Investing as lending.

Can you update the twitter link from Ron Butler? I can't see his post about the OSFI considering ending residential mortgage by banks. I pray that it is the case cause that will be huge. It is legit what is needed to end this craze of financialization of housing. I don't know who thought it was a brilliant idea to give the cheapest and most tax advantaged lending to buying a house.