Image of the day: GTA pre-construction condo prices

Deny Sullivan: The Folly of Pre-Construction Condos.

As you can see from the chart, the tide has shifted for now. Condo buyers from 2022, most of whom are probably still waiting on construction to finish, have likely lost money. Prices have dipped ~6% since January 2022, which means your deposit has lost 31% of its value (including the leverage).It’s no surprise that condo sales are in free fall.

The takeaway is that Ontario’s obsession with condos & pre-construction financing is a mistake. It’s a mistake that worked tremendously well for 15 years, but it is and was still a mistake. It’s a mistake that will be painful for many for years to come. And the sooner Ontario stops expecting mom & pop investors to make wild, leveraged bets to fund its construction industry, the better.

Perhaps this is too pessimistic - but it’s certainly true that a risky investment is going to sell for a lower price rather than a higher price. So it’s hard to see how prices can keep going up.

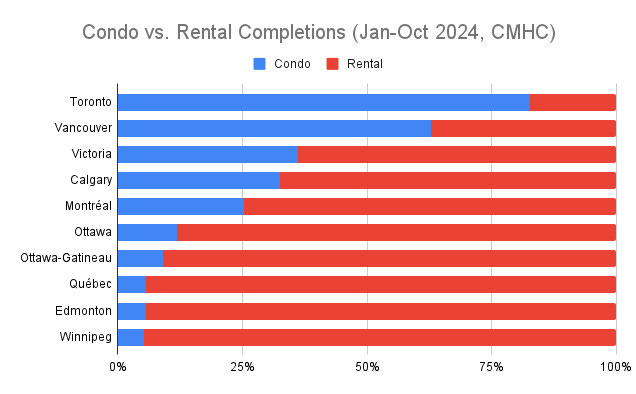

It’s mostly the GTA and Metro Vancouver that build a lot of condos:

Oh the Urbanity! on Bluesky, based on CMHC data.