Metro Van: Surrey, Burnaby, and Richmond vote to proceed with hikes to charges on new housing

"Growth pays for growth" means "younger people pay for infrastructure upgrades"

TLDR: The Metro Van board just voted to shift the bill for water and sewer infrastructure upgrades away from existing property owners (who tend to be older and wealthier) to homebuyers and renters (who tend to be younger and poorer).

We desperately need more housing, and increasing the development charges on new housing will make it even harder to build new housing.

If you’d like to give your opinion to the elected officials who voted for this, here’s the email addresses for the Surrey, Burnaby, and Richmond directors:

Surrey:

Mayor Brenda Locke <mayor@surrey.ca>

Gordon Hepner <ghepner@surrey.ca>

Harry Bains <harry.bains@surrey.ca>

Rob Stutt <rob.stutt@surrey.ca>

Pardeep Kooner <pardeep.kooner@surrey.ca>

Mike Bose <mike.bose@surrey.ca>

Burnaby:

Mayor Mike Hurley <mayor@burnaby.ca>

Pietro Calendino <pietro.calendino@burnaby.ca>

Sav Dhaliwal <sav.dhaliwal@burnaby.ca>

Richmond:

Mayor Malcolm Brodie <mayorea@richmond.ca>

Bill McNulty <bmcnulty@richmond.ca>

Chak Au <chak.au@richmond.ca>

There's been a standoff over the Metro Vancouver Regional District's plan to fund water/sewer infrastructure upgrades by hiking development charges on new housing, which will significantly slow down the rate at which we're building desperately needed new housing.

The federal government asked MVRD to postpone the increases (currently scheduled to start in January 2025), and MVRD staff prepared an option for the MVRD board to postpone them by one year without affecting the five-year budget.

The MVRD board voted on Friday, 82-58, to go ahead with the increases. The Vancouver councillors voted to accept the one-year delay; Surrey, Burnaby, and Richmond voted to reject it. (Votes are weighted by population: those four municipalities have 60% of the votes on the MVRD board.)

What this means (from a Redditor who works in the industry):

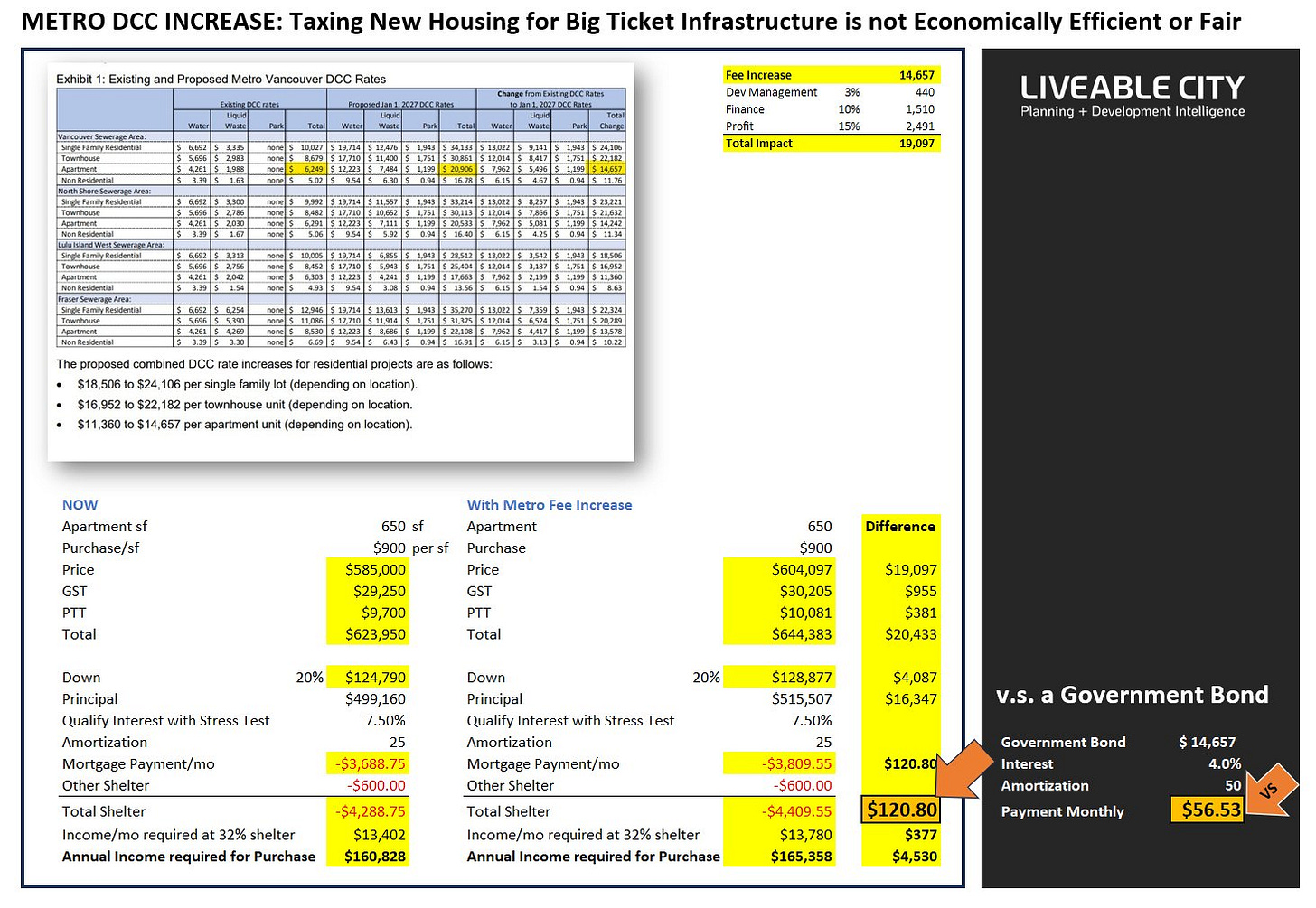

Metro Vancouver is increasing its DCCs on new development. They're phasing in increases starting 2025, and finishing with step 3 in Jan 2027. A Vancouver apartment will see its Metro Vancouver DCCs rise from $6,249 per unit to $20,906. More than tripling in a 3 year span. A Vancouver townhouse, which I assume any future plex development will fall into, will have even more substantial increases, going from $8,679 per unit to $30,861. More than 3.5x increase.

For apartments: let's say you have a 16,500 SF lot at 2.2 FSR = 36,300 buildable square feet. Let's call that 50 suites. That's an additional $733,000 by 2027. About $20 per buildable.

The $20 per buildable represents about a 10-15% decrease in the value of development land for rental (in the city of Vancouver, even more where rents are lower). It just got that much harder to convince owners to sell, assemble sites, and build rental. Build anything, really.

Background:

Metro Vancouver board plans to hike development charges on new housing

Canada's housing minister urges Metro Vancouver to think twice on development charges

Letter from Sean Fraser to Metro Vancouver board asking for a one-year delay

Stop Hosing Homebuyers with Water-Related Development Charges. Benjamin Dachis, May 2018. “Municipalities should eliminate development charges for water and wastewater and instead levy full-cost user fees that cover the full cost of amortized capital. This is the pricing model that private and municipally owned utilities in the natural gas and electricity market have used for decades without relying on up-front fees.”

Metro Vancouver Board Meeting Agenda Package for October 27, 2023.

The consulting firm Coriolis prepared a report (see page 314 onward) comparing the impact of the DCC increases to the impact of higher “hard” construction costs (basically labour and materials), higher interest rates, and finally higher sales prices and rents. The impact of the DCC increases is comparable to the impact of the increase in interest rates, but not as great as the impact of hard costs. The key thing is that the effect is cumulative: to get the total impact, you add them all up. To offset these impacts, you need higher prices or rents.

For a low-rise rental project in Vancouver:

The most dramatic impact for Coriolis’s case studies was for a high-rise strata project in Surrey.

Response from Sean Fraser

Dan Fumano:

In an emailed statement after Friday’s vote, Fraser said he was “disappointed with the news out of Metro Vancouver’s board meeting today.”

“I have concerns that moving forward with significant increases in development charges given extremely challenging market conditions could deter home building that would otherwise occur in the absence of such costs,” Fraser said.

“Some of the cities within Metro Vancouver have been amongst the most ambitious leaders on housing in the country for many years. The federal government will be there for these cities, including with financial support through the housing accelerator fund,” Fraser said. “Before finalizing the funding decisions, I will be re-examining the proposed initiatives in each city’s application, and will make necessary adjustments where the initiatives conflict with the position taken at today’s Metro Van board meeting.”

In the meantime, Fraser said, “I will continue my efforts to accelerate the pace of home construction in Canada, and will work with home builders, non-profits, housing advocates, and different levels of government, including the municipal leaders in Metro Vancouver.”

More

I'm not sure whether elected officials really understand that development charges end up getting paid by homebuyers and renters, through higher prices and rents.

I've heard the argument that if a project gets lower development charges, it's not going to lower its prices, therefore prices don't depend on development charges. This is a fallacy ("fallacy of composition"): a single project which has unusually lower costs can maintain a higher price because its competitors have higher costs, and conversely if you raise development charges on a single project, it can't raise its price. But this is different from a cost increase which affects all competing projects. In this case, they all can and will raise their prices.

The specific mechanism is that the cost increases make fewer projects economically viable. Projects end up having to wait until prices and rents rise before they can proceed.

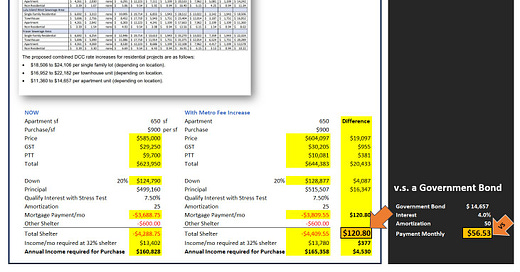

Michael Mortensen has put together an example of what the numbers look like for an apartment, assuming that the MVRD can borrow at 4% and that a homebuyer would need to be able to afford a mortgage at 7.5% to pass the stress test.

News stories

'Akin to a hostage-taking': Metro Vancouver goes for development fee hikes despite Ottawa's warning. Dan Fumano, Vancouver Sun.

Metro Vancouver development fee hikes set up potential federal showdown over housing cash. Simon Little, Global News.

Metro Vancouver defies feds, approves tripling of development charges. Martin MacMahon and James Paracy, CityNews.

Defying Federal "Threat," Metro Vancouver Approves DCC Increases. Howard Chai, Storeys.