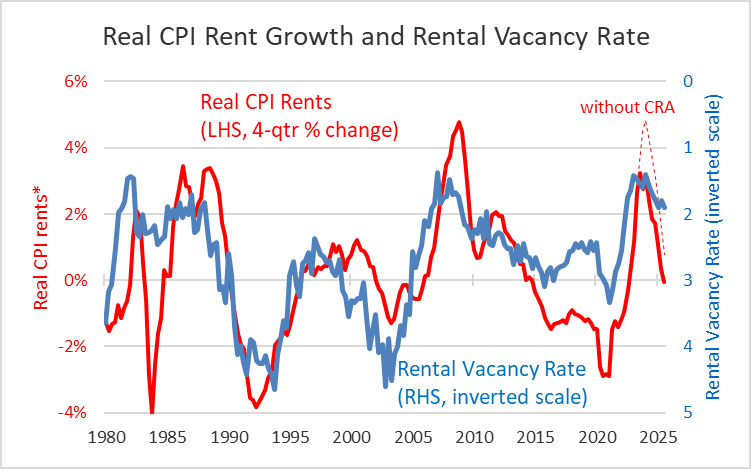

Image of the day: rent growth vs. inverted vacancy rate in Australia

Inverting the vacancy rate makes the correlation very easy to see.

The housing market remains tight. In September 2025, REIA’s rental vacancy rate was 1.9%. In the past, vacancies this low have helped predict rents rising noticeably faster than inflation.

This shouldn’t need repeating, but as the chart shows, the gap between supply and demand drives changes in the cost of housing. So if we increase supply, rents will be lower than otherwise.

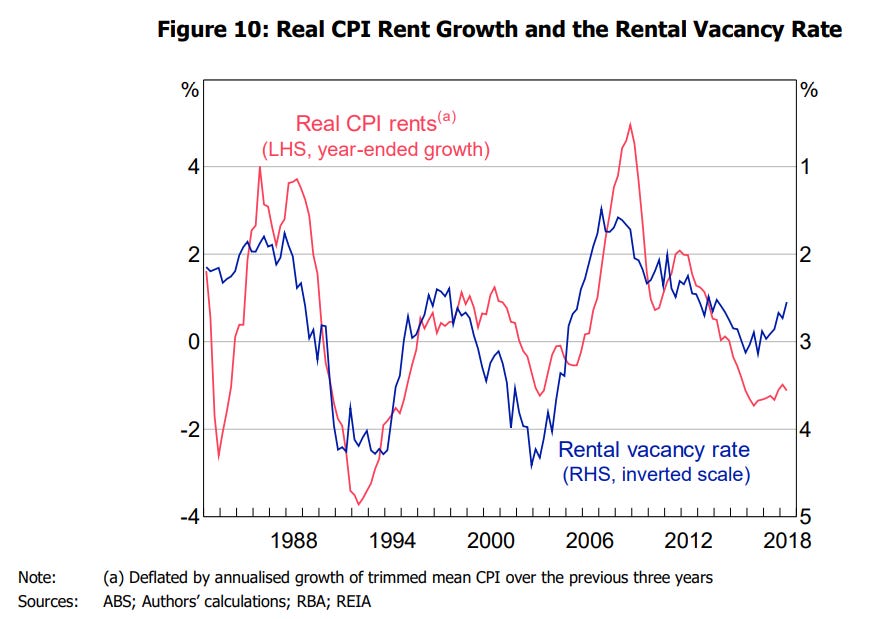

For more discussion, see Saunders and Tulip, 2019:

The dominant influence on real rents is the vacancy rate, as shown in Figure 10. This effect is analogous to the Phillips curve in the labour market. However, whereas the Phillips curve seems increasingly difficult to see (Gillitzer and Simon 2015), the effect of an excess supply of housing on changes in rents is clear, with the coefficients on the vacancy rate in Equation (3) being highly significant. It is sometimes questioned whether the balance of supply and demand affects the cost of housing (Phibbs et al 2017; Coates 2018), but the evidence seems to be strong.

Similarly, without the inversion: