Market rents dropping in the GTA

A boom-and-bust cycle: starts are low but completions are still high

A post to r/PersonalFinanceCanada on Reddit: Renegotiate your rent.

Rents are dropping around the GTA in most places and if you are paying too much, consider negotiating at the end of your lease.

A few months ago I posted that my rent was above market at a whopping $2850 a month and we even received a rent increase notice. When I spoke to the property manager they cancelled the rent increase and said it was a mistake.

I was not satisfied. They had listed other units in the building for $2500. So I asked for that rate and the building manager said no.

So I gave the building an N9 and the super of the building called me the same day to ask what they can do to keep my family from leaving. (We are good tenants.)

I said I wanted the rate everyone else was paying $2500 and free parking. Which now they accepted when I was about to walk away.

But again. Before they served us a new lease at the new rate so I could sign and lock in. They lowered rates to $2300 on the same units. So I went back to negotiate again and they are hemming and hawing about it.

Anyways. Be prepared to walk away obviously. But also be aware of the area rental rates. We moved at peak rents last year to get up to $2850 in rent and only a year later it is now $2300. Rents all around me have dropped dramatically. We would be insane to accept paying a higher rate just for being loyal and so would you.

A similar story by Salmaan Farooqui in the Globe and Mail, May 2025. Free month’s rent, parking spaces and utilities: Landlords are clamouring to attract tenants.

A study in April by Urbanation found vacancy rates for purpose built rentals completed since 2000 reached 3.7 per cent in the Greater Toronto and Hamilton areas for the first quarter of 2025. That’s compared to 2.6 per cent in the first quarter of 2024.

The report also found that the number of available condo rental listings was 29 per cent higher than a year ago and 160 per cent higher than two years ago.

The vast majority of promotion offers are for new condos and townhomes, where investors are under the most pressure.

Shane Dingman, Globe and Mail, June 2025. Toronto condo renters play their strong hand.

“I’ve had units at [the condo building at] 55 Mercer that I have not leased; the landlord looked at market rents and said ‘I’m not locking in there,’” said Joshua Raxlen, broker of record for Homewise Real Estate. His company represented about 50 units out of hundreds that went up for rent when the downtown Toronto project by developer CentreCourt finished construction in 2024. As with many downtown Toronto condos in the current market, the most cash-hungry landlord often determines the market price for the entire building.

“There’s two kinds of investors in the building; people who don’t need the money to cover the mortgage – and they will say, ‘Screw it, I’ll leave it empty.’ And some are desperate,” Mr. Raxlen said. If a better-financed landlord wants to rent a two-bedroom unit at 55 Mercer for $3,400 but a desperate landlord is willing to take $3,100 for an identical apartment, tenants will take the lower price. “That second person becomes the market-maker.”

Unfortunately this boom in supply is only temporary. In order to keep prices and rents going down, costs - like development charges - would have to decline enough for new projects to be viable. GTHA Sees Slowest New Condo Sales In Over 30 Years, Construction 'Collapses.’ Teagan Sliz, Storeys, April 2025.

In Q1, new condo construction was down 79% compared to Q1-2024 and at its lowest quarterly total since 1996 with only 497 sales, indicating that "collapse" of construction, according to the report. Currently, there are only 69,042 condo units under construction in the GTHA, a decline of one-third over the past two years.

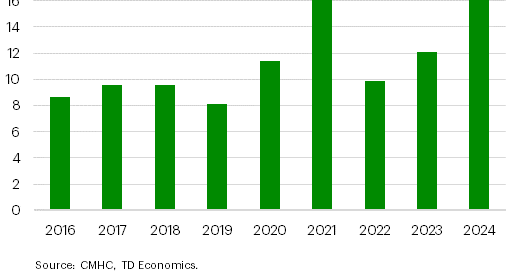

Condo completions, on the other hand, remained 67% higher than the 10-year average in Q1, despite dropping 16% from last year, and completions are expected to total 31,396 units by the end of 2025. The current wave of completions stems from the pandemic-era condo boom and is expected to taper off as the condo market continues its downwards trajectory, with completions falling to just 17,487 units in 2026, projects Urbanation.

More

Previously: unsold condos.

According to the June 2025 Rent Report from Rentals.ca, asking rents for a 2BR in the city of Toronto have dropped 10.7% from a year ago.

I think the tack we must take is that after getting out of social housing over a generation ago, we've given the free market system ample opportunity to prove it could do better, and its done much worse.

I don't know whether the blame speculators or foreigners or what - the free market normally works to provide needed goods(!) - but if *everybody* is too dumb to just see the problem and solve it, then I'm for the social housing construction.

Vancouver says the industry is about to lay people off - the office staff today, the constructors tomorrow as the current projects end - let's plan ahead to hire them for public projects as they are freed up.