Vancouver proposes temporary 20% cut to DCLs

Staff report: Supporting Development Viability

Report Back on Supporting Development Viability and Unlocking New Housing Supply. Staff report on the Standing Committee on City Finance and Services agenda for December 10, 2025.

City of Vancouver eyes changes to make housing development more viable. Dan Fumano, Vancouver Sun, December 2025.

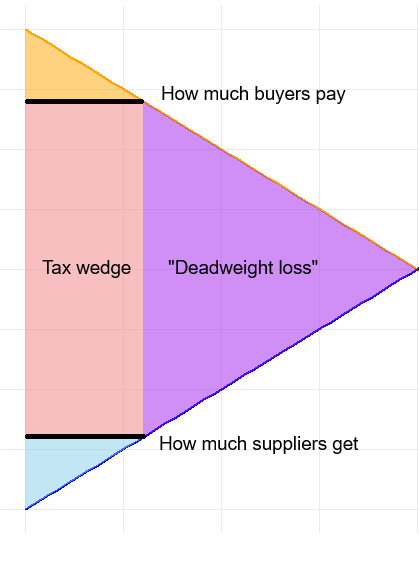

Over the last couple of years, prices and rents have been declining, which is good news for first-time homebuyers and for renters. But costs act as a floor on prices. Prices can’t go below costs: “We lose money on every sale, but we make it up on volume” isn’t a good business plan. In the longer term, in order to keep building and keep pushing down prices, we need to figure out how to bring down costs.

Although the proposed reduction to development levies would mean the city collects less money on each project, Josh White said, “We don’t collect it unless the project proceeds.”

“Eighty per cent of a good volume is a heck of a lot better than 100 per cent of nothing,” White said. “We probably would never have gotten that $300 million in the first place, because more projects would struggle to get from approval into actual construction.”

The city hopes to make up at least some of that revenue through the federal government’s commitment in last month’s budget to help fund “housing-enabling infrastructure” for municipalities that reduce development charges.

Recommendations

At Wednesday’s standing committee meeting, city staff are presenting a report on bringing down costs which are under the control of the city, to revive projects which have been pushed underwater. Key measures:

Provide a temporary 20% reduction in the city’s Development Cost Levies. If the federal government agrees that this is a “substantial” reduction, there may be federal funding available via the Build Communities Strong Fund.

Allow payment of 75% of the DCLs to be deferred until occupancy or four years after the first payment, whichever comes first.

Reduce the discount for below-market housing in the Broadway Plan area, to CMHC city-wide average rents (instead of 20% below CMHC city-wide average rents). This is still a discount below current asking rents, but it’s not as large.

Plus there’s a long list of other measures:

Use a simpler calculation of storage space that’s not counted towards the floor-space limit.

Use a standard requirement for family-size apartment mix: in both condo and rental projects, at least 35% of the apartments must have at least two bedrooms, and at least 5% must have three bedrooms. The 3BR requirement is more costly for rental projects (currently there’s no requirement), less costly for condo projects (the current requirement is 10%).

For shared amenity spaces and balconies, don’t have a maximum on the amount of space which isn’t subject to the floor-space limit.

Have a standard requirement for external windows. Allow “inboard” bedrooms with no external wall, with frosted-glass windows near the ceiling to pass through light from another room that does have an external window.

Remove the Transport Demand Management requirement.

Provide a temporary discount for public art contributions.

Large projects are currently required to have a mandatory Community Benefits Agreement, to meet certain social goals: at least 10% of procurement must be local and have beneficial social impact, and same for hiring. Make this optional rather than mandatory.

The report also includes an Attainable Home Ownership pilot program that would involve working with the provincial government.

There’s a number of initiatives underway as part of the broader Permit Improvement Program, including:

Using a list of “Typical Conditions” for infrastructure requirements, especially for smaller projects (six storeys or less)

Exempting more projects from sewer capacity review, based on the more stringent rainwater management requirements added to Vancouver’s building code

Simplifying offsite transport designs

Reducing parkade setback requirements

The impact of the 20% DCL reduction would be about $45M (a bit less than 2% of the city’s $2.4B annual budget). A 2% property-tax increase seems like it would be a reasonable step, but Ken Sim’s already ruled it out with his “zero means zero” stance on the budget.

Allowing 75% of the DCL payments to be deferred would have a more sizable impact. There was a June 2025 council decision allowing two-thirds of the payments to be deferred, which would have an impact of $140M (looking at the funding available for the current capital plan). With the proposed changes, the impact increases to $200M. The incremental change is $60M, or about 2.5%; the total impact is $200M, or about 8.3%.

Previously:

Pretty decent start. Now what is the appetite at city Hall like for actually adopting any of these recommendations?