Reduced viability in the Broadway corridor

How much floor space does the city need to dole out?

Summary of Economic Testing for R3 and R5 Districts in Broadway and Cambie. Blair Erb, Coriolis. Appendix L of a July 2025 city staff report on pre-zoning in the Broadway Plan area.

The report is based on market conditions as of the period between December 2024 and February 2025. It’s basically calculating the minimum density required in order for projects to make sense, in the form of a maximum floor space ratio. (FSR translates to how much floor space is allowed, based on the size of the site: e.g. 2.0 FSR on a 33x122 lot, about 4000 square feet of land, means you’re allowed to build 8000 square feet of floor space.)

As Michael Mortensen says, “Vitamin D” - density - is what you need to make projects work. People are willing to pay for floor space, either by buying it (in the case of strata) or renting it. There’s a big gap between how much it costs to build floor space, and how much the resulting floor space is worth, because of the city’s restrictions on floor space. The city’s current approach is similar to that of OPEC: they sell permission to build floor space in limited quantities, at high prices.

From the report:

New housing development is challenging from a financial perspective under current market conditions due to low demand for new presale strata units, flat (or declining) rents, high financing costs, increasing regional development cost charges, and construction cost pressures. Therefore, projects are not currently able to support (financially) the same amount of affordable housing and/or amenities as projects have provided in the past (assuming the same densities).

The report is based on the following assumption:

In order for a scenario to be financially viable, the land value supported by a redevelopment scenario needs to be approximately equal to (or higher than) the value of the property under its existing use and zoning.

This assumption seems extremely optimistic.

When you’re buying land from a homeowner, there would have to be a substantial premium, about 30%, to persuade them to sell and move.

Similarly, when you’re buying an income property (an existing low-rise rental building), the seller is going to have to pay taxes on the capital gains, and then find something else that will generate a similar stream of income. So they’ll want a premium as well, say 20-30%.

Thus Coriolis’s floor-space numbers (FSR) should be regarded as a lower bound. The actual FSR required in order for a project to make sense would be considerably higher.

Lower bounds on how much density is needed

Coriolis’s estimates of minimum density when replacing old single-family houses or duplexes:

On a single lot, low-rise apartment buildings (either strata or rental) require significantly more than 1.75 FSR to be viable (which is about four storeys, assuming 50% site coverage). The lots that Coriolis looked at were from 6300 square feet to 7400 square feet.

On a lot assembly, low-rise wood-frame strata buildings require 2.4 FSR (five or six storeys) to be viable. On the west side, low-rise wood-frame rental buildings require 3.0 FSR (six storeys), since people aren’t willing to pay as much for rental as they are for strata. On the east side, somewhat less FSR would be required, somewhere between 2.4 and 2.7 FSR, because land on the east side is less expensive and requires less density to reduce the cost of land per square foot of floor space, despite rents being lower there. The lot assemblies were each two adjacent lots, total size between 12,000 and 15,000 square feet.

On a lot assembly, a concrete rental building with 80% market and 20% below-market (cross-subsidized by the 80% market) requires somewhere between 5.5 and 5.75 FSR to be viable on the east side (about 12 storeys assuming 50% site coverage, more if site coverage is lower), or 7.25 to 8.5 FSR on the west side (about 18 storeys).

On a lot assembly, a low-rise wood-frame rental building with 80% market and 20% below-market would need more than 3.0 FSR to be viable on the west side (not possible with 50% site coverage), but 3.0 FSR should be viable on the east side.

When replacing an older low-rise apartment building, rental or strata, with a high-rise, on a site between 20,000 and 25,000 square feet:

A rental building with 80% market and 20% below-market is not viable at 6.5 FSR. It would need somewhere between 10 and 11 FSR.

This doesn’t look that different from Coriolis’s findings back in 2021, perhaps because rents are higher.

The current Broadway Plan pipeline

From the latest staff report on the Broadway Plan implementation, Q2 2025.

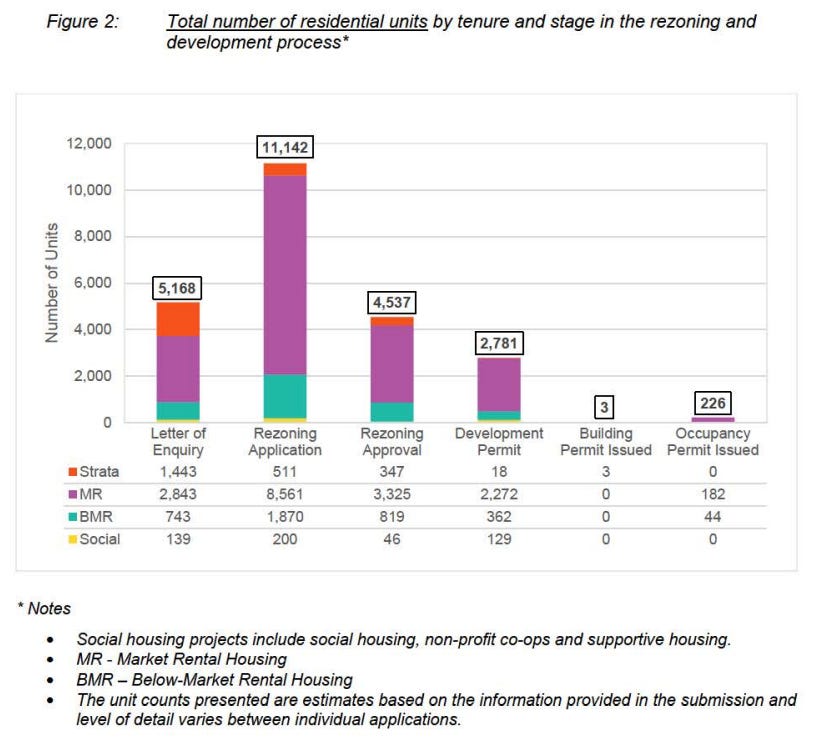

There’s a strong incentive to try to get your rezoning approved as soon as possible, even if you’re not intending to build right away, because Vancouver only allows two high-rises per block face. So the key question is, which projects have proceeded to applying for a development permit? Right now there’s a total of a bit less than 2,800 apartments at that stage, mostly rental apartments.

The 226 apartments (182 market rental, 44 below market) which are now ready for occupancy are for the 39-storey rental project at Broadway and Granville.