Previously: BC Budget 2024, BC Budget 2023.

The 2025 BC budget was released yesterday. I read through it, looking for housing-related measures. There’s a fair amount of discussion of the potential impact of Trump’s trade war. BC is somewhat less dependent on the US export market compared to other provinces.

The 2024 budget included $200M for the new middle-income BC Builds program, over three years. The 2025 budget adds another $320M. The budget document notes that the program also has access to a $2B provincial revolving fund, plus a matching $2B from the federal government via the ACLP (formerly RCFI).

The 2025 budget adds $375M for increases in rental supplements for low-income families and seniors.

The Rental Assistance Program provides eligible low to moderate income working families with assistance to help with their monthly rent payments. To qualify, families must have a total before-tax household income below a threshold, have income at some point in the last year and have at least one dependent child. Budget 2025 will increase the income threshold from $40,000 to $60,000 and increase the average supplement families receive by nearly 75 per cent from around $400 per month to $700 per month. These changes are expected to nearly double the number of families receiving supports from around 3,200 to nearly 6,000 families.

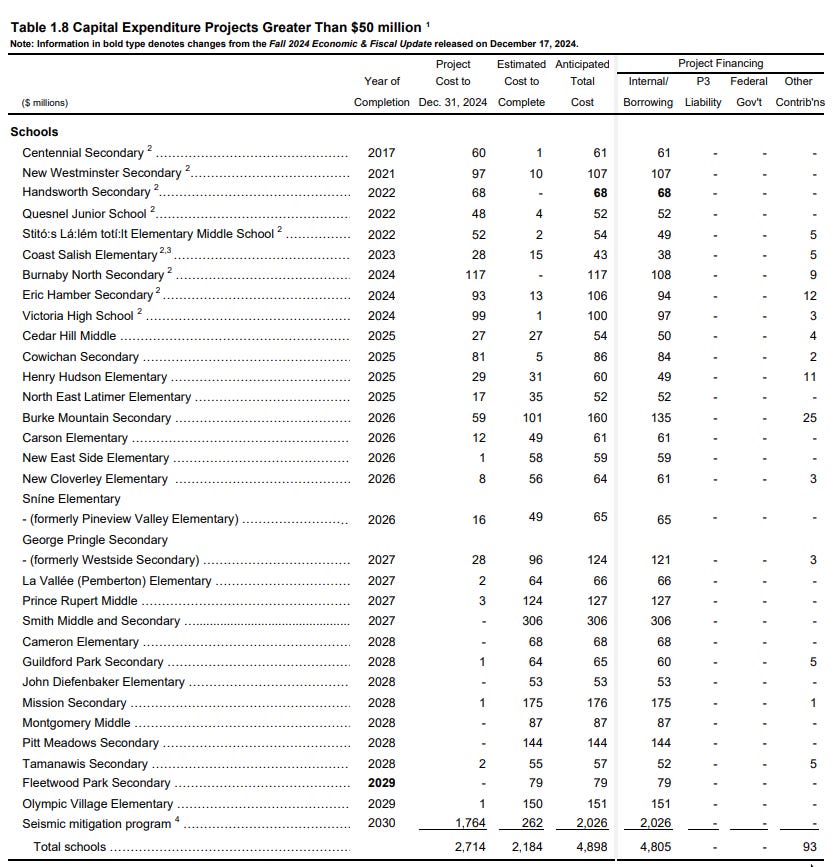

The three-year plan includes $2.8B in capital spending on housing. There’s examples of specific projects on pages 38-39. Table 1.8 lists projects over $50M, and includes a number of housing projects:

The Olympic Village elementary school has made it onto the list of projects over $50M:

The post-secondary projects list includes a fair number of student housing projects. It’d be useful to know the number of beds for each project.

On the revenue side, the rates for the speculation and vacancy tax are increasing. The expected increase in revenue is about $50M in 2026/2027.

Effective January 1, 2026, the rate for Canadian citizens and permanent residents who are not untaxed worldwide earners, as well as others currently taxable at 0.5 per cent under the Speculation and Vacancy Tax Act will increase from 0.5 per cent to 1 per cent.

The rate for foreign owners and untaxed worldwide earners, as well as others specified under the Speculation and Vacancy Tax Act currently taxed at 2 per cent, will increase from 2 per cent to 3 per cent.

The new tax rates will apply to the speculation and vacancy tax payable by property owners based on the use of their residential properties during the 2026 calendar year and onward, and will not impact taxpayers declaring based on the use of their residential properties in 2025 or before.

Homebuilding rates are above the 10-year average, but just barely:

What’s ahead:

Residential building permits (a leading indicator of home construction) fluctuated throughout 2024, while overall trending lower over the first eleven months of the year. Year-to-date to November 2024, the value of residential building permits declined 8.3 per cent compared to the same period of 2023, and the number of residential units permitted have decreased 10.8 per cent.

Is it naïve to think that $150M for an elementary school seems incredibly high? What's driving the cost there?