Previously: BC Budget 2023.

The 2024 BC budget was released on February 22. Last year’s budget increased spending on housing by $4.2B over three years, divided about equally between operational spending and capital spending.

This year’s budget has some smaller additions, described on pages 8-9.

There’s a new anti-flipping tax.

There’s more property transfer tax exemptions for new purpose-built rental housing, for first-time homebuyers, and and for new owner-occupied homes.

There’s another $116M for operating social housing.

There’s $200M for the new BC Builds program, which builds middle-income housing on public land.

Most of the new funding allocated in this budget is for health care ($6B over three years), along with education, public safety, and social supports.

The three-year plan includes $2.4B in capital spending on housing. There’s specific examples given on pages 44-45.

There’s a list of projects over $50M on pages 46-52. Public services like schools are complementary to housing - as we add new housing, we also need to expand schools. There’s a lot of school projects, but the Olympic Village school hasn’t made it through the approval process and onto the list yet.

Property transfer tax exemptions

The specifics of the property transfer tax exemptions are described on page 70.

The general property transfer tax applies for all taxable transactions. The general property transfer tax rate is:

1% of the fair market value up to and including $200,000

2% of the fair market value greater than $200,000 and up to and including $2,000,000

3% of the fair market value greater than $2,000,000

If the property has residential property worth over $3,000,000, a further 2% tax will be applied to the residential property value greater than $3,000,000.

For new rental housing, the 2023 budget removed the “further 2% tax.”

The 2024 budget removes the property transfer tax on new rental housing entirely, for a period of five years. “Effective for transactions that occur between January 1, 2025, and December 31, 2030, purchases of new qualifying purpose-built rental buildings will be exempt from the general property transfer tax.”

Additional exemptions:

“The first time home buyers’ exemption eliminates the property transfer tax liability for eligible first time home buyers, provided the fair market value of the purchase is below the designated threshold. Effective April 1, 2024, the threshold is increased from a fair market value of $500,000 to $835,000.” The exemption phases out from $835,000 to $860,000. Confusingly, the text also says that the first $500,000 is exempt from property transfer tax, not the first $835,000.

“The newly built home exemption exempts qualifying purchasers from property transfer tax for the purchase of a principal residence. Effective April 1, 2024, the fair market value threshold is increased from $750,000 to $1,100,000.” The exemption phases out from $1.1M to $1.15M.

Housing supply outlook

See pages 83-86. It looks like housing starts are likely to slow down rather than accelerating:

Residential building permits (a leading indicator of home construction) eased in 2023 following strong growth in the previous two years, signaling potential moderation in homebuilding activity going forward. Last year, the value of both single-dwelling and multiple-dwelling permits fell by 18.3 per cent compared to 2022. Also, the total number of residential units permitted was down by 16.5 per cent.

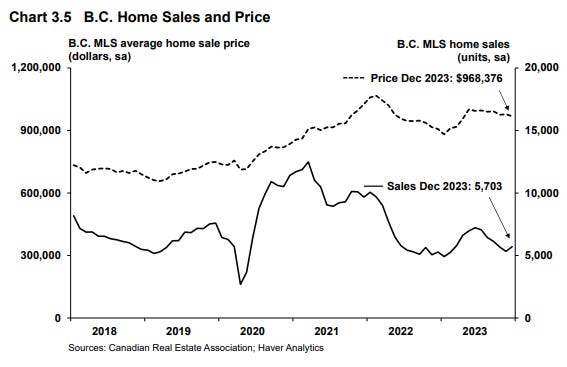

Sales are down, prices haven’t fallen much: