Austin: building more housing, rents falling

An email to Burnaby mayor Mike Hurley

Douglas Todd recently wrote a column in which he interviewed Burnaby mayor Mike Hurley. I thought it was pretty sensible, but Hurley mentioned that he was skeptical that building more housing will make it cheaper. Burnaby mayor bemoans stark highrises, but sees few options.

Naturally I sent him an email.

Subject: Does housing supply matter?

Hello, Mayor Hurley. I'm a software developer who lives in Vancouver and works in Burnaby. My work has nothing to do with housing, but like most people in Metro Vancouver, I'm extremely concerned about how scarce and expensive housing is.

I saw a recent Douglas Todd column which quoted you:

When senior levels of government keep throwing out there that the more houses we build the cheaper they’ll get, I think they’ve been listening to developers too much.

I haven’t seen anywhere in the world where that’s actually true. And I’ve asked people to provide me the data to back up what they’re saying. And no one has ever been able to. There’s just no proof.

One of the clearest examples right now is Austin, Texas, a city of about 1 million people. They've been growing rapidly since Covid hit, rents went up, a lot of people launched projects to build more apartments, and now rents are dropping. Most recently, rents dropped 12% from December 2022 to December 2023.

New housing frees up older housing. Every time a new building with 100 or 200 apartments opens up, whether it's market or non-market, that's 100 or 200 households that are no longer competing with everyone else for existing housing.

I've included some charts below.

Best regards,

Russil Wvong

morehousing.ca

The overall picture in Texas:

Unprecedented levels of in-migration and a trend of corporate relocations caused demand for apartments to spike in Texas in the early years of the pandemic, pushing rent growth into the double digits. Developers rushed to cash in on the nation’s most promising real estate investment, fueled by cheap debt and a growing pool of renters unable to afford a home.

Since then, competition has increased as new supply floods the market and the cost of capital has gone up. Owners who financed their properties using floating rate debt are facing the difficult prospect of refinancing, leaving some with few options but to sell at a discount or hand keys back to the bank.

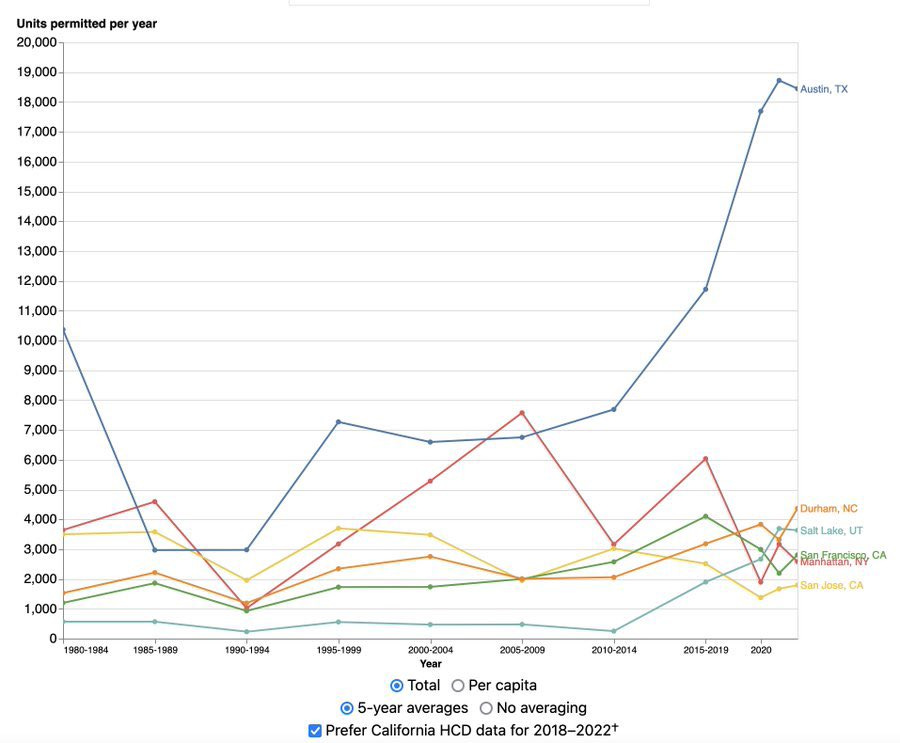

Homes permitted in Austin, mostly apartments:

An Austin real estate syndicate reporting to its investors that it's going bankrupt, because vacancies are rising and rents are dropping:

Several factors have led to financial challenges in the multifamily real estate market and this specific asset. The reality is that we acquired this property in December 2021 at the peak of the market, and since then, multifamily fundamentals have deteriorated rapidly. In December 2021, SOFR was 0.05%, Austin market occupancy stood at 93%, and this asset was bought at a 3.4% cap rate. Since then, SOFR has risen to 5.32%, Austin market occupancy has dropped to 88% with a 20-30% increase in supply coming available leading to the lowest Austin market occupancy of all time.

Multifamily cap rates have expanded to a 6% cap rate. Even if the market stabilizes at a 5% cap, we must increase NOI by 50% to get back to breakeven. NOI ultimately cannot cover both debt service increasing from $171k per month to $340k per month, and increased operating expenses.

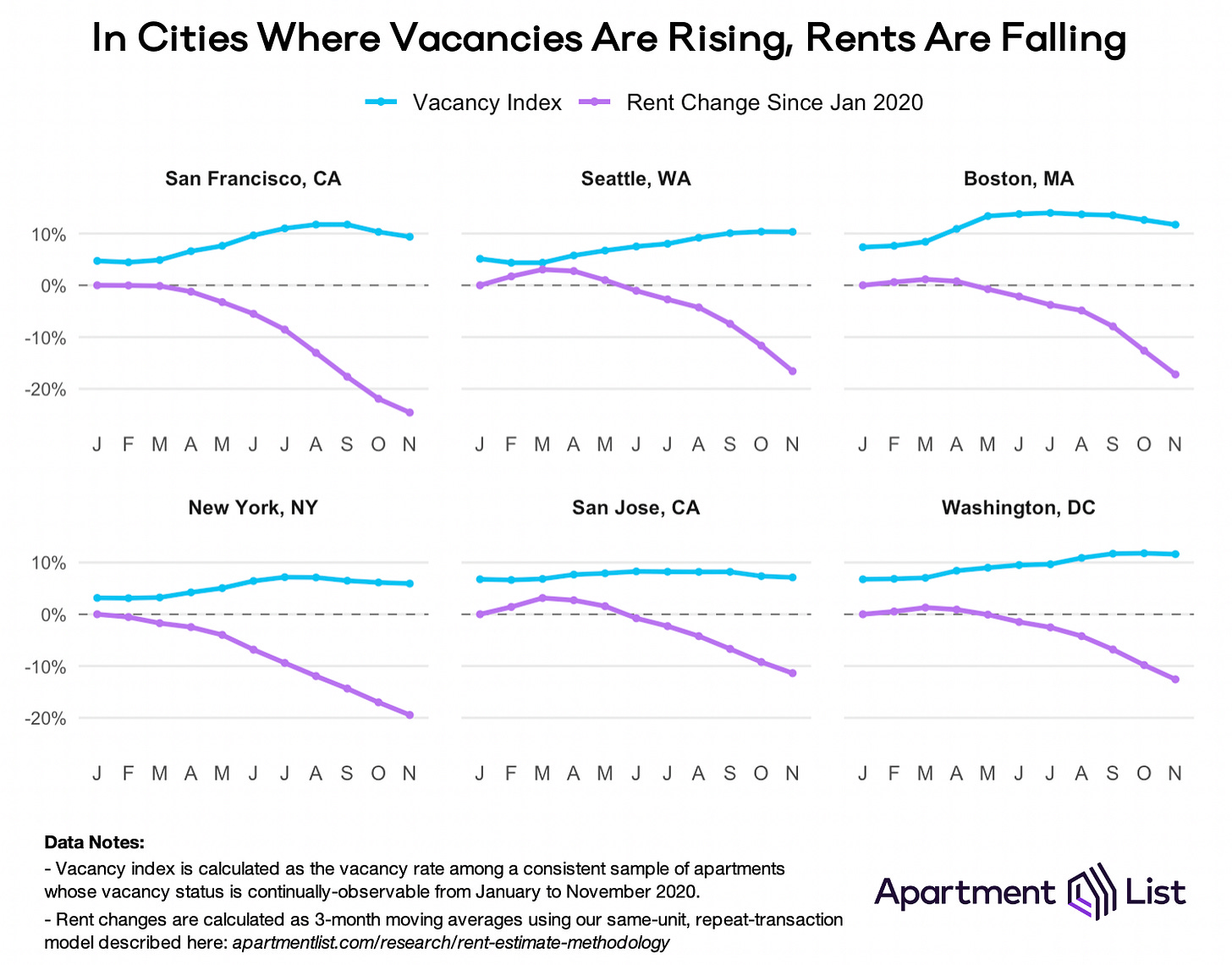

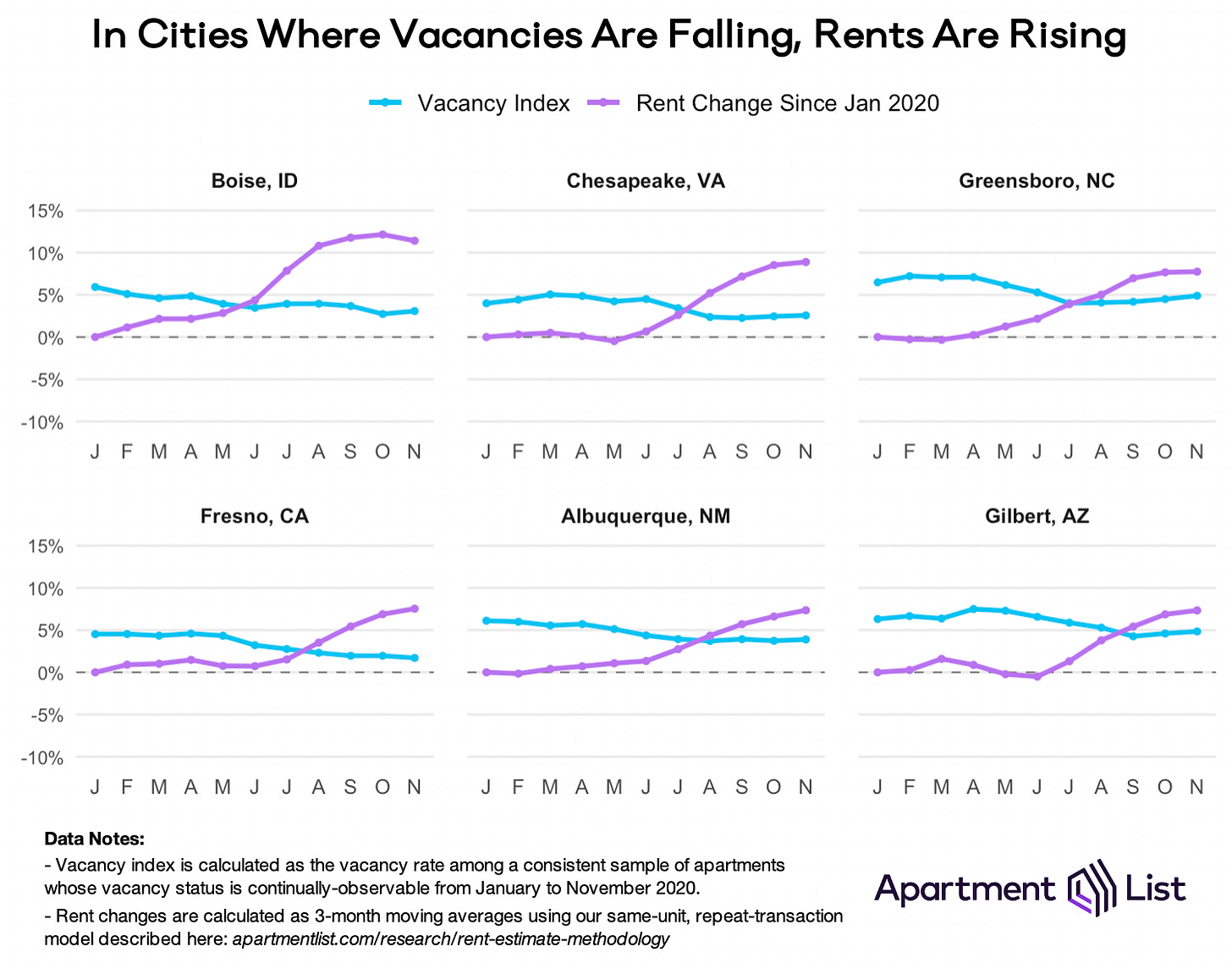

Some more recent evidence that supply and demand matters even in expensive cities, from when Covid first hit. Data is from January to November 2020. With the sudden surge in remote work, demand spilled over from expensive cities to smaller centres. (Which is why senior governments are so involved right now - housing being scarce and expensive is no longer a problem confined to Metro Vancouver and the GTA.)

By the way, you sometimes hear skeptics argue that if supply really mattered, Metro Vancouver should be cheap, because it builds a lot of housing. If you look at Edmonton vs. Metro Vancouver, you can see that Edmonton builds much more during booms:

I really appreciate this one. Mayor Hurley made a similar comment to me last year and I wanted to follow up with a detailed email but never got around to it.

Part of the difficulty was that he seemed to be demanding an amount of evidence that may not even exist. Basically he was looking for a deeply unaffordable city that managed to build its way into being affordable. He brought up Seattle and said something to the effect of "so their rent went down 3%... so what? That's not a major difference". I tried to explain that a 3% rent decline versus Burnaby's 30% rent increase is incredibly significant, but it didn't seem to sink in.