Home ownership at a 40% discount

Attainable Housing Initiative launches at Heather Lands

Press release: Partnership between MST Nations, Province will help thousands own their first home in Vancouver.

Many, many people in Metro Vancouver have given up on ever owning. It’s simply too expensive to buy, even a condo apartment.

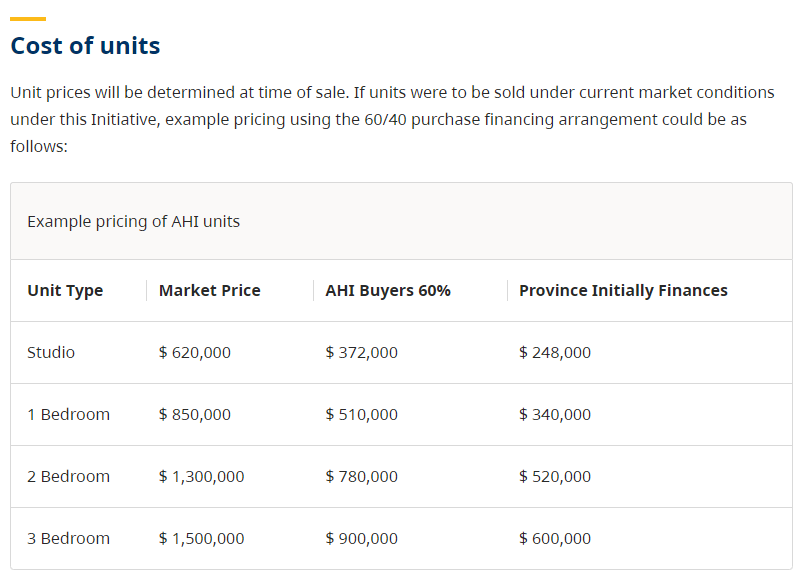

The BC government announced last Thursday that they have an agreement with the MST Nations, who are developing 2600 apartments on the Heather Lands, between 33rd and 37th. The provincial government is making a $670M loan to the MST Nations, and the MST Nations will sell the resulting 99-year leasehold apartments to first-time homebuyers at 60% of market value. This will significantly accelerate the rate at which the homes can be built and sold, because it means that there’s a lot more people who can afford them.

It’s a program aimed at people who primarily want a secure place to live, not an investment asset that will appreciate. If you sell the apartment before 25 years are up, you get 60% of the market-price proceeds, with the rest going back to the province.

On the plus side, if Metro Vancouver succeeds in building a ton of apartments over the next 10 or 20 years and prices actually start coming down, you're protected from some of the downside risk. Just as you only get 60% of the gain if it goes up, you only take 60% of the loss if the value goes down.

Aimed at first-time homebuyers

Specific requirements:

Eligibility for the AHI that must be met at the time of pre-sale:

Have a total annual household income below $131,950 (as of 2024) and net household assets below $150,000 [not including RRSP accounts], to be eligible for studio and one-bedroom leasehold homes

Have a total annual household income below $191,910 (as of 2024) and net household assets below $250,000, to be eligible for 2-bedroom, or larger leasehold homes

Buyers must be a citizen or permanent resident of Canada

One buyer must have resided in B.C. for the past 24 months consecutively

Buyers must be at least 18 years of age

Buyers must not own an interest in any other property anywhere else in the world at the time of purchase closing

Buyers must prequalify for a mortgage and must have the minimum deposit of at least 5 percent of the value equal to 60 percent of the market purchase price

Use the home as the owner’s principal residence

If a buyer’s life circumstances change after qualifying at the pre-sale (such as a buyer’s income increases), the buyer remains eligible. Homebuyers in the Initiative must continue to keep the home purchased through this Initiative as their primary residence, or else the 40 percent provincial financing will become due (see below).

If there’s more buyers than apartments available: there’ll be prioritization: first-time homebuyers, then previous homeowners who don’t currently own, then current owners with minor children who are planning to sell their current home.

Construction is expected to start in 2025.

If you sell, the buyer pays market price. The 40% financing is only available for the first buyer.

If you don’t ever want to sell, after 25 years you repay the 40% financing (based on the original purchase price) to the province, with 1.5% annual compound interest (which is less than target inflation).

Bringing home ownership within reach

An op-ed in the Hub by Mike Moffatt and Cara Stern, back in March, stressed the importance of bringing home ownership back within reach. The dream of Canadian homeownership is dying. Here’s how to revive it.

If you want a well-functioning economy, people must have hope that hard work will lead to success. But in Canada, people are giving up. A recent poll by Abacus found that a full 74 percent of Canadians believe housing affordability will get worse for first-time homebuyers in 2024 and that 57 percent of non-homeowners are either pretty pessimistic or have given up hope entirely of ever being able to buy a home. That’s up from 48 percent since September 2023.

Locking young people out of home ownership is bad for the political fortunes of incumbent governments and bad for the economy. It is also a threat to the social stability of Canada, according to a recent RCMP report. Therefore, all orders of governments need to restore the dream of homeownership to Millennials and Generation Z, while creating abundant options for renters.

Additional housing supply for both owners and renters is necessary. But building new supply will take time. Governments cannot expect people to feel good about the measures taken to increase housing supply if they’re living in unsuitable spaces, with only the promise that supply may restore affordability in a decade or more. Canadians need solutions now, so the government needs to find ways to get existing homes into the hands of first-time homebuyers.

Federal government loosening mortgage rules

Along the same lines, the federal government recently announced that they’re loosening mortgage rules, effective December 15. (This was one of Moffatt and Stern’s suggestions.)

The two big changes:

Insured mortgages (allowing you to put 5% down instead of 20%) are now available for a property worth up to $1.5M, up from $1M.

You can get a 30-year amortization instead of 25-year, lowering monthly mortgage payments somewhat (while increasing the total interest that you pay).

Moffatt argues that raising market-clearing prices, by loosening mortgage restrictions, is needed to keep new supply from coming to a halt (which will also raise prices!).

Prices absolutely have to come down. But only sustainable way to get there is costs coming down. Without that, we'll have zero build for a few years, and then the mother of all price hikes.

Developers are sitting on a stack of unsold condos because condo sales have dropped off a cliff, and a lot of condo projects are currently on hold.

In the longer term, we need to lower costs - like development charges - which act as a price floor.

Don’t listen to the critics, Canada’s new mortgage rules will make housing more affordable — eventually. Mike Moffatt, Toronto Star.

These mortgage reforms are being made under a backdrop of exceptionally weak new home sales, particularly in the GTA. In August, new home sales were 73 per cent lower than the 10-year average. The condo market is being hit particularly hard, with condominium sales in the GTA and Hamilton at their lowest level in 27 years. Worse, the pre-construction condo market has ground to a halt. Housing starts are down across the GTA, and the outlook for 2025 and 2026 is weak, as there are no condo starts without condo pre-construction sales.

If these mortgage reforms work as intended, they should help resurrect new home sales and the pre-construction condo market, increasing supply.

More

BC Attainable Housing Initiative to finance 40% of Heather Lands presale prices. Howard Chai, Storeys.

Eby steadies bumpy pre-campaign with mortgage relief promise. Rob Shaw, Business in Vancouver.

Ottawa to ease mortgage rules in bid to help buyers afford pricier homes. Rachelle Younglai and Bill Curry, Globe and Mail.